Uneven Recovery in the APEC Region amid Uncertainty

Rising interest rates, unwinding of massive fiscal support and stubborn inflation dampen growth

The global economy continues to grapple with the cost-of-living crisis as relatively high inflation persists while financial sector strains have emerged as monetary policy rates increased. Fiscal space has narrowed as debts surged following massive stimulus measures to preserve lives and livelihoods amid the pandemic. Despite these efforts, income levels have not recovered to pre-pandemic levels in most APEC economies and inequality has widened as the pandemic hit the most vulnerable populations the hardest.

Slow and uneven growth, high inflation

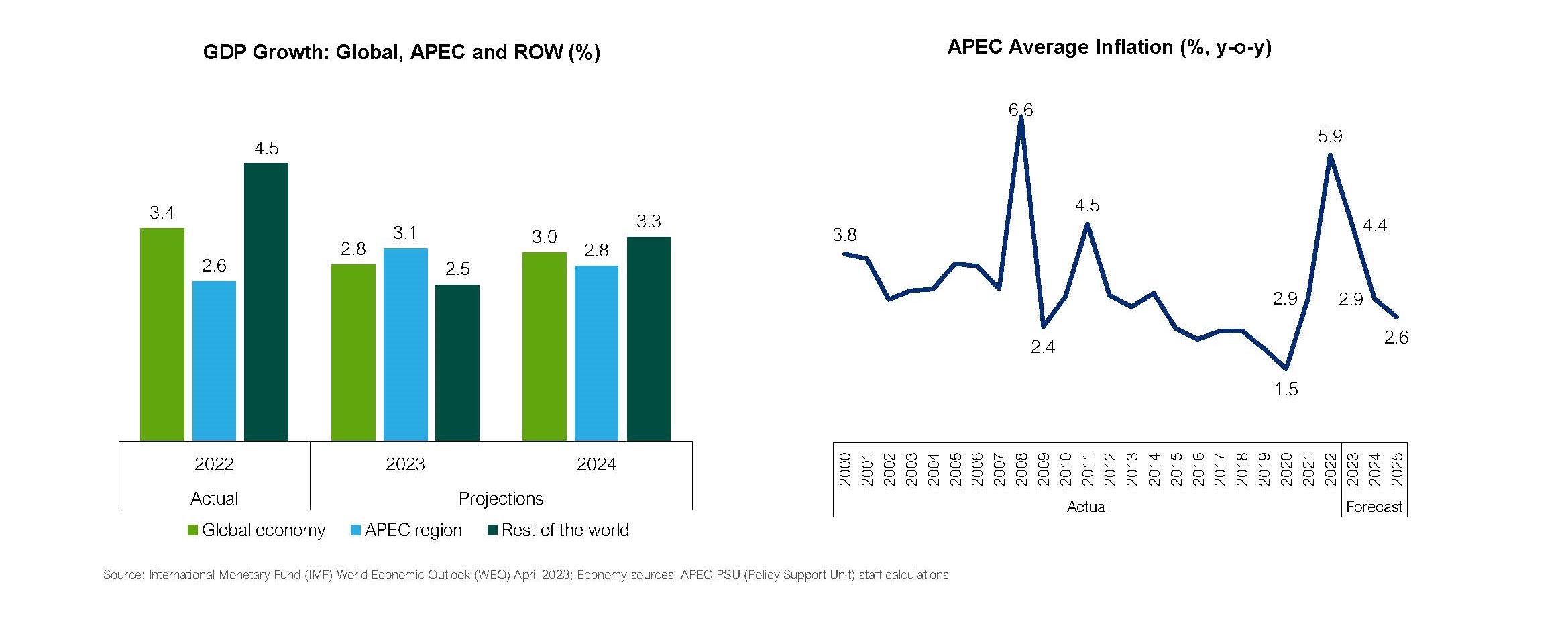

Medium-term projections point to growth hovering between 2.8 to 2.9 percent, the lowest GDP growth in 20 years, excluding the 2008-2009 global financial crisis (GFC) and the pandemic-related economic recession. Tighter financial conditions and narrowing fiscal space resulted in lower GDP growth for the global economy and the APEC region as debts surged amid the pandemic-dampened economic activity. In particular, APEC grew at a slower pace of 2.6 percent in 2022 from 6.2 percent in 2021. Growth is expected to remain uneven, with only nine APEC economies growing above 3 percent in 2023.

Supply-demand imbalances compounded by geopolitical issues put an upward pressure on prices. APEC inflation reached 5.9 percent in 2022 from 2.9 percent in 2021. The inflation outlook has been adjusted slightly upwards to 4.4 percent in 2023, before declining to 2.9 percent in 2024. Most APEC economies have been using monetary policy tools at their disposal, such as implementing interest rates hikes, to stem inflationary pressures.

Downside risks dominate

A high degree of uncertainty surrounds growth prospects. The announcement by OPEC+ in April 2023 to reduce oil production by 1.16 million barrels per day is fueling inflation concerns. Moreover, higher debt levels have contributed to the narrowing of fiscal space in the middle of an economic slowdown. Estimates of general government gross debt recorded a surge in 2022 to 112 percent of GDP for advanced economies while it reached 65 percent of GDP for the APEC region—the highest level ever posted.

In addition, geoeconomic fragmentation could result in large output losses from lower FDI and trade flows, reduced employment opportunities and declines in productivity gains due to limited technology and knowledge transfers. Changing demographics—with aging populations becoming an economic burden—could also affect economic growth, particularly in the medium and long term.

Financial sector remains stable in the APEC region despite multiple headwinds

The swift and strong interventions by monetary and financial authorities in the US and Europe after the collapse of the Silicon Valley Bank, Signature Bank and Credit Suisse have served to calm markets and avoid a widespread loss of market confidence that could threaten financial and macroeconomic stability.

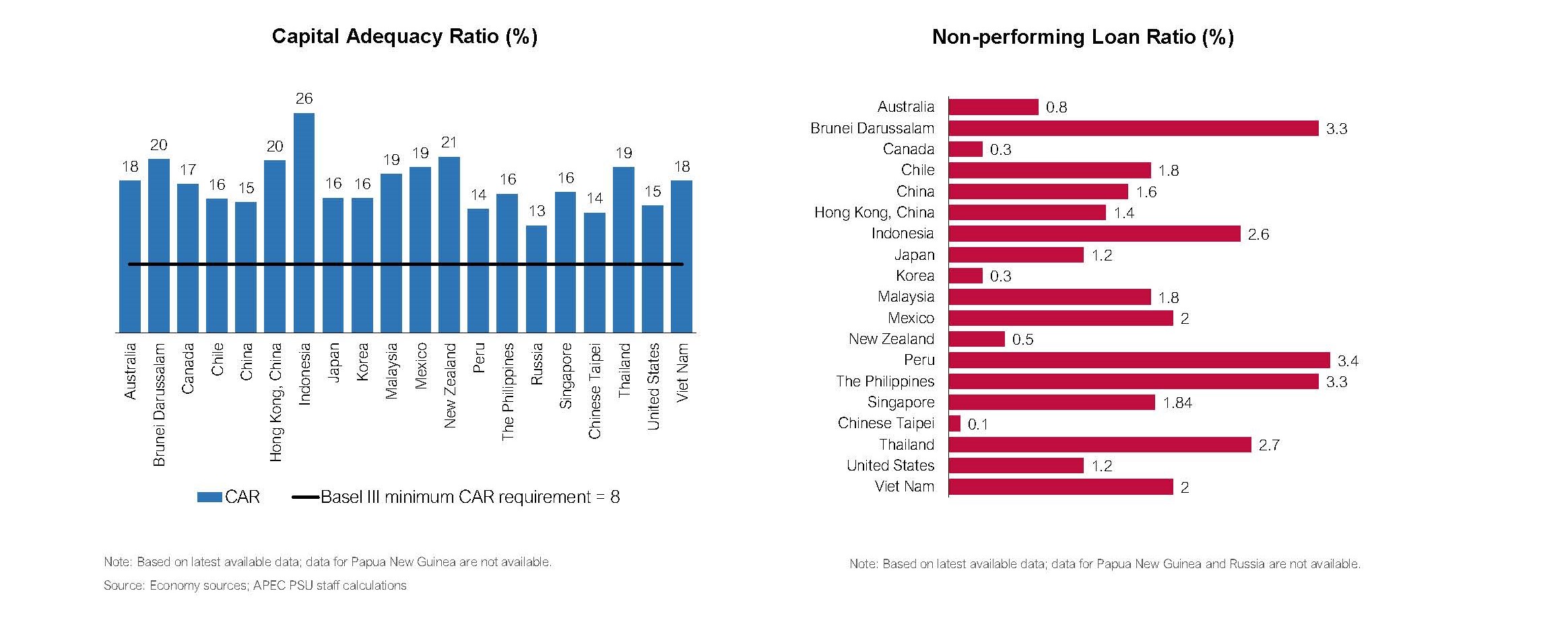

Amid these financial sector strains, monetary authorities need to stay vigilant to ensure that banks’ liquidity and capital remain sufficient while non-performing loans (NPL) remain low. The banking sector in the APEC region remains sound as the capital adequacy ratio (CAR) of all APEC member economies exceeds the 8.0 percent requirement set by the Bank for International Settlements (BIS). In addition, the NPL ratios among APEC economies are relatively low, ranging from 0.3-3.4 percent of total loans.

Policymakers need to remain vigilant of risks and shifting sentiments. At the same time, they need to remain flexible in order to respond quickly to financial market volatilities. Liquidity buffers as well as strong supervisory and macro-prudential measures are essential to maintain stability. However, it remains important that authorities strike a balance between maintaining financial sector stability and taming inflation, as higher interest rates could reduce the capacity of firms and consumers to manage debts, which in turn could give rise to negative transmissions to the banking sector through weaker bank balance sheets.

Sluggish trade in goods performance and strong recovery in trade in services

APEC trade activity decelerated in 2022 from double-digit growth in 2021 as the momentum from a pandemic-related recovery dissipated and global demand weakened. Merchandise trade volume in APEC expanded marginally by about 1.1 percent for exports and 1.2 percent for imports in 2022 compared to the level in 2021. Heightened global commodity prices, contractionary monetary policies to combat inflation, and disruptions in global value chains due to COVID-19 outbreaks contributed to the moderation in trade growth.

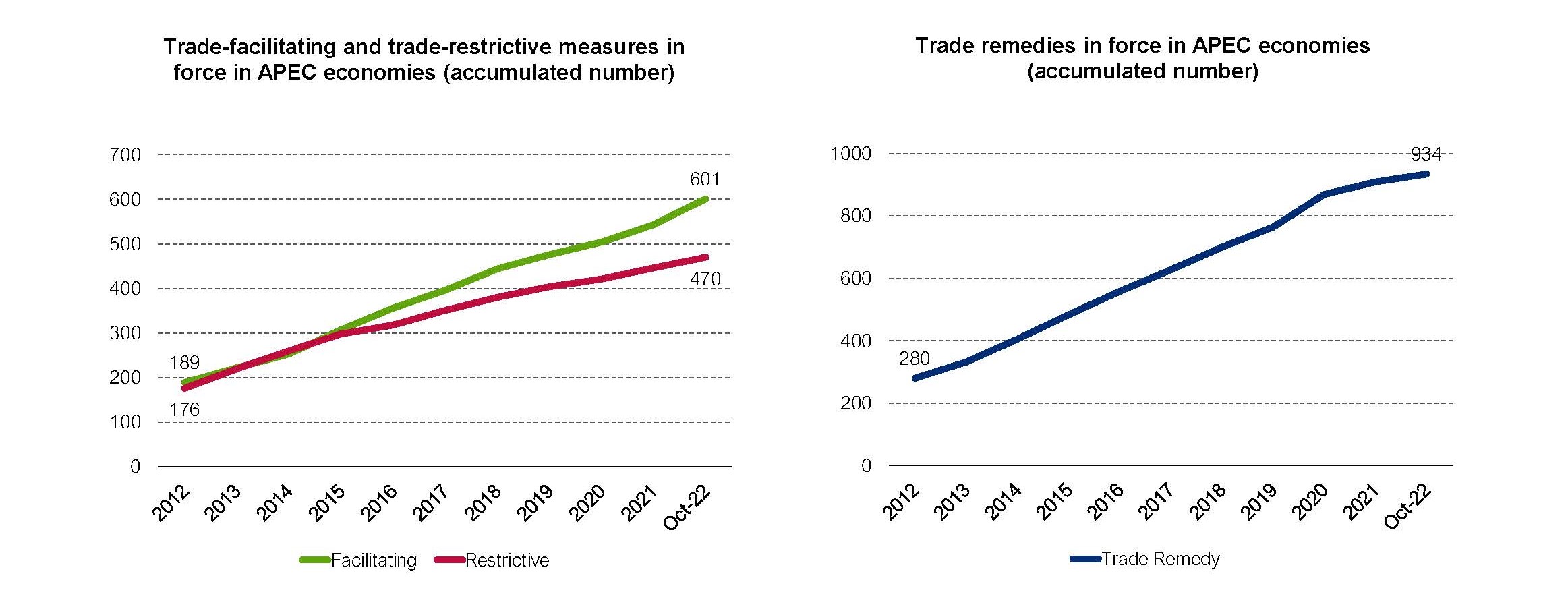

It is likely that merchandise trade volumes post low growth rates in 2023, with the deceleration of the global economy, ongoing geopolitical developments and increasing credit costs adversely affecting global demand. In addition, it is important to keep an eye on the evolution of trade-related measures. In recent years, trade-facilitating measures have outnumbered trade-restrictive measures; however, the accumulation of the latter is cause for concern, particularly regarding export restrictions and bans. Furthermore, the number of trade remedies in force, mainly anti-dumping measures and countervailing duties, is growing.

Partly inflated by elevated global commodity prices, the value of merchandise trade in APEC surpassed the USD 12 trillion mark for both exports and imports in 2022 but has started to show signs of deceleration. While its value grew by more than 26 percent in 2021, its growth rate was slashed by more than half in 2022 (9.3 percent for exports and 10.2 percent for imports).

In contrast, the latest data on trade in commercial services in APEC paints a rosier picture. International tourism is leading this change towards full recovery as cross-border restrictions and quarantine requirements have been relaxed. In the first three quarters of 2022, APEC trade in commercial services continued growing strongly by around 15 percent to USD 1.8 trillion for exports, and 17.4 percent to USD 1.8 trillion for imports relative to the same period in 2021, propelled mainly by transport and travel services.

Rising inequality exacerbated by the pandemic

One of the main consequences of the pandemic is the decline of living standards in many APEC economies. Lockdowns and social distancing measures restricted several economic activities, leading to job and income losses.

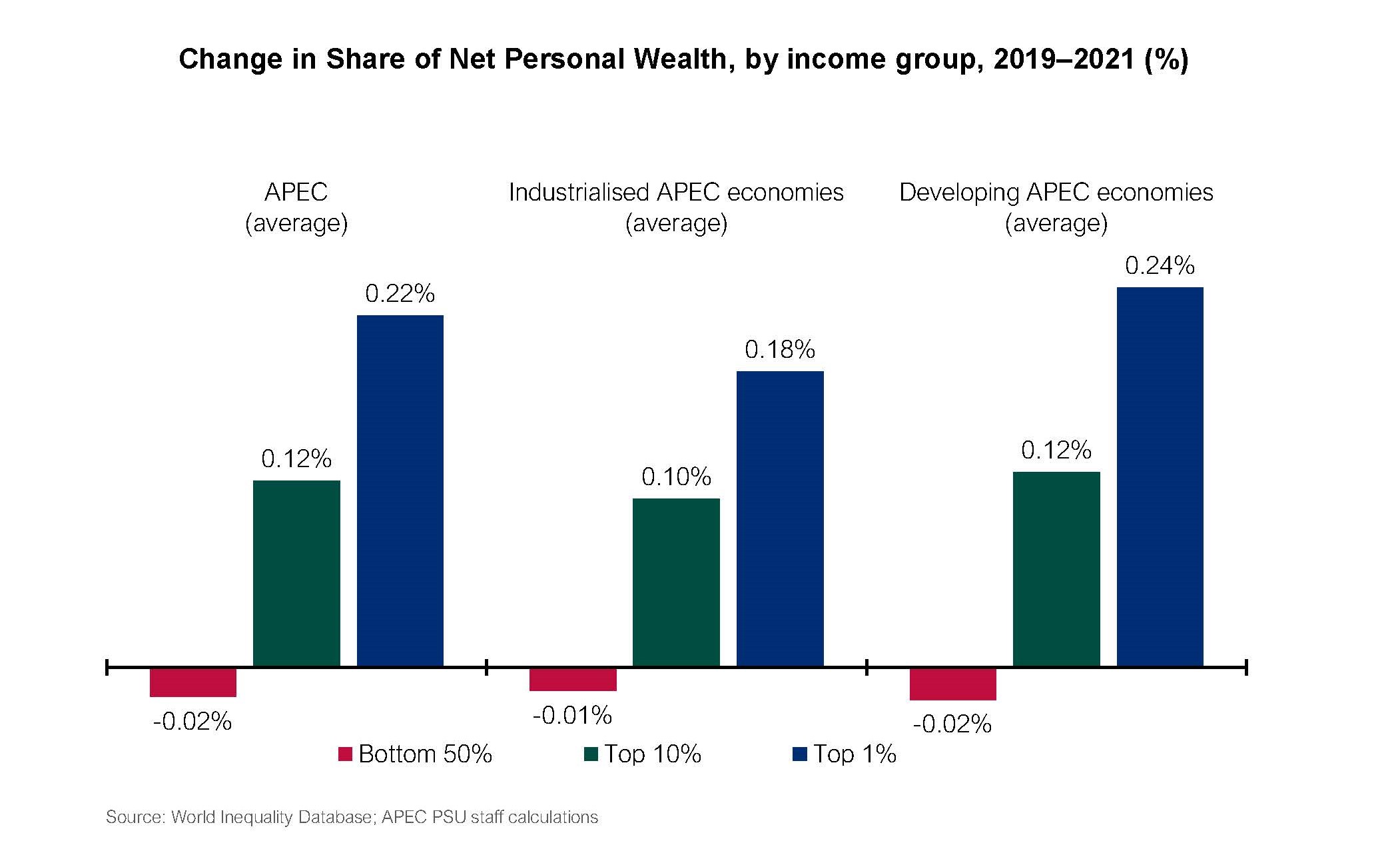

Comparing income data from before and during the COVID-19 pandemic reveals that average income levels were worse off one year after the pandemic started in more than half of APEC economies. Another negative consequence is rising inequality in all APEC economies, as those in the bottom 50 percent of the population experienced a decline in their share of net personal wealth, as opposed to those in the top 10 percent and top 1 percent of the population.

Issues such as informality conditions and lack of resources or knowledge to access digital tools and platforms increased the vulnerability of those in the bottom 50 percent right from the start of the pandemic. This trend may continue in the future, as gaps in educational attainment widened with school closures related to the pandemic affecting mostly children from poor households who have inadequate educational resources and lack access to digital devices or the internet to study online.

Policy recommendations

Growth has become slower and more uneven at a time of heightened uncertainty, stubborn inflation and other emerging risks. In view of these challenges, APEC could consider the following policy options, mindful of different domestic factors and economic priorities:

- Monetary policy to remain focused on bringing down inflation to mitigate cost of living crisis. Effective communication is necessary to promote transparency and manage market expectations. Policymakers need to remain vigilant amid financial sector stress, strengthening liquidity buffers and macro-prudential regulations to identify risks and vulnerabilities. At the same time, they have to use all available tools at their disposal to be able to strike a balance between maintaining financial sector stability and taming inflation.

- Fiscal policy should be on the side of prudent spending and support the inflation objective of monetary authorities; if necessary, government spending should be targeted to protect those vulnerable to the cost-of-living crisis.

- Promote debt sustainability through fiscal consolidation as appropriate and implement structural reforms aimed at promoting human capital development and improving product, labor and financial markets.

- The role of regional cooperation is more important than ever to encourage inclusive dialogue and concerted efforts to achieve growth objectives; remove trade restrictions and bolster supply chains for food security; and accelerate strategies to reduce carbon footprint to contain global warming at 2°C.

***

Rhea Crisologo Hernando is senior researcher and Carlos Kuriyama is director at the APEC Policy Support Unit.

This article is based on the latest APEC Regional Trends Analysis co-authored with Glacer Niño A. Vasquez.