The “Three Friends of Winter”: How Economic Policy has Addressed the Major Crises of our Time

Introduction

Any artist can paint the greens of spring time, the blues of summer, the browns of autumn. But it is when the skies and landscapes turn grey and cold and dormant, that the real test of the artist arises. For centuries (since the Song Dynasty and even earlier) Chinese ink brush painters have turned to the form of vegetation that stayed vigorous and growing in winter: the pine, the bamboo, the plum. They symbolise endurance, flexibility and perseverance in difficult circumstances. These are the “Three Friends of Winter” (Suihan Sanyou in Chinese).

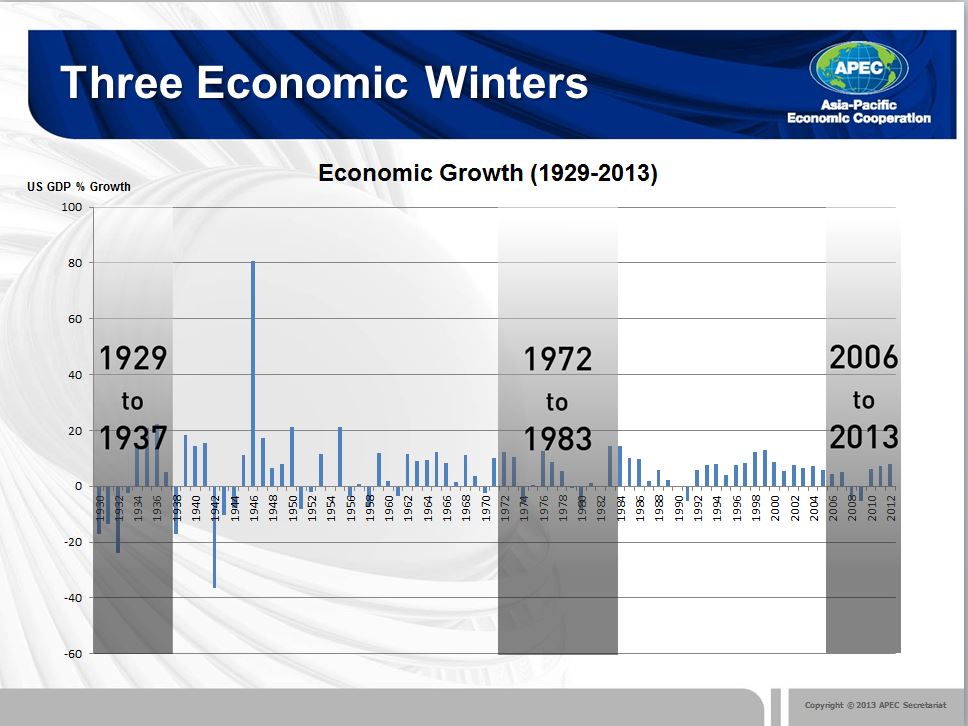

My real topic in this talk is not Chinese art but Western economic policy. I have selected three economic winters to examine: the Great Depression, the Great Inflation, and the Global Financial Crisis. They each occurred about forty years apart, they each affected the world, and they have each spawned new economic thinking. In each case I identify an economic “artist” who helped create new policy tools, and how these made a difference to these wintery landscapes.

The recurring theme is that such economic winters do generate new friends. Economic thinking is stimulated, economic pioneers surface, and new economic tools are developed for practical policy use. But this can be a slow and complex process.[1] In my native New Zealand I filled a number of economic policy roles and I use these experiences to illustrate what we learned from these three winters.

Early Thinking on Economic Policy

Western classical economic thinking evolved out of Renaissance views of the world, the study of moral philosophy, and the life-changing effects of the Industrial Resolution. One of the first classic works of economics in that tradition, the piece that Adam Smith himself considered his major contribution, was entitled “The Theory of Moral Sentiments”, and it sought to explain why people have both private and public motives . For several centuries Smith and his followers in Britain and Europe saw their contributions as explaining economic life, rather than changing it. Those with economic training worked as private tutors, church ministers, and university academics. Key universities like Cambridge, Edinburgh, Bologna and Heidelberg were remote centres of learning, not located in centres of government.

This comfortable and distant ivory tower role for economic academics has altered under the tempestuous process of last century and a half: economic colonization, the race for commercial resources, rapid globalisation, the 1880s recession, banking crises in the 1900s, a European arms race, and the rise of Marxist thinking. World War I sparked a new era of American dominance. It also bred economists and politicians (particularly in the US) who were less likely to accept the status quo, and who sought opportunity to intervene to change things for the better. Examples were Woodrow Wilson’s project on the League of Nations, on one side of the Atlantic, and John Maynard Keynes’ prescient study “The Economic Consequences of the Peace”, on the other.

There cannot be economic policy without appropriate economic policy institutions, and these economic institutions of government had been evolving. Central Banks had existed in Europe for many years, but the establishment of the US Federal Revenue System, marked a new approach to regulation. During the volatile 1920s, central banks attempted to stabilise the monetary system of the major economies.[2] But their intervention and regulatory controls showed the thinking of administrators rather than economists. Treasuries were focused on raising (very low) tax revenues. Government sectors were tiny compared with today. There were few government officials with economic training, and those who had did not work as economists but as administrative officials or civil servants. The British tradition, somewhat similar to the Confucian tradition, was to employ generalists who above all valued training in classics.

Economic teaching at universities had evolved from classical to neoclassical, and was framed by the thinking of micro-economists interested in markets, like Alfred Marshall at Cambridge. Macroeconomics, in so far as it existed, was still largely laissez-faire classicism, relying on market prices to guide allocation, and treating governments like large private agents.

The First Winter of the 1930s: The Great Depression

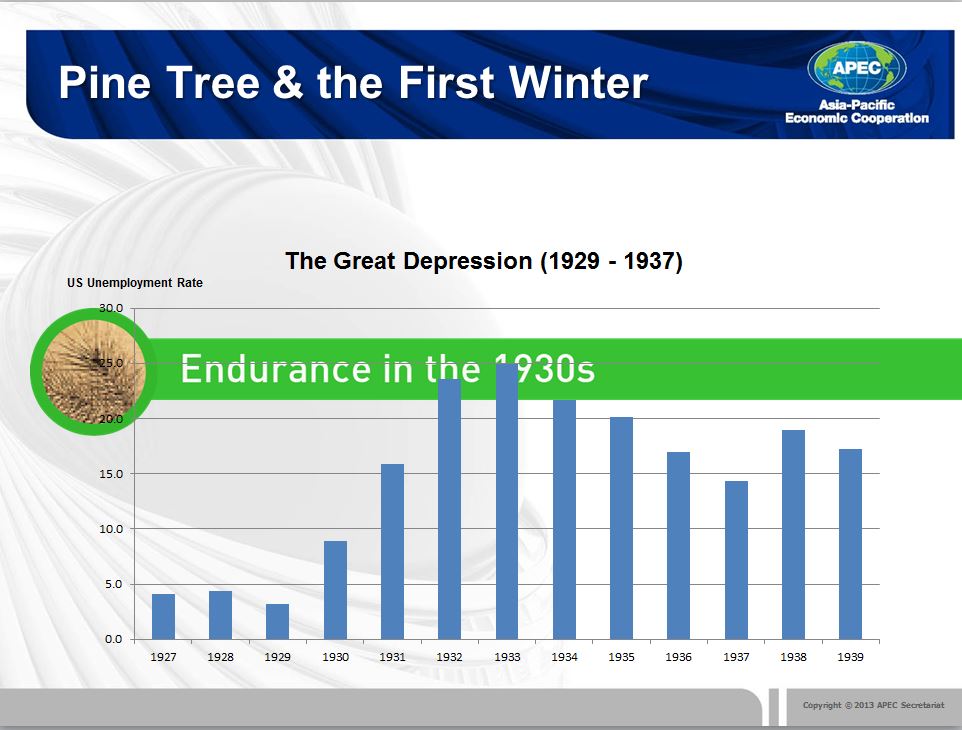

The pine tree symbolises endurance. Endurance was the byword for the terrible conditions of the 1930s. A major world contraction that followed the volatile 1920s, started in earnest with the 1929 stock market slide, and continued on and off until World War II. Within four years the US economy contracted by a third.

Today the Great Depression remains the biggest global economic shock in memory, and it has stimulated much soul-searching about public policy and the role of economists. The default position of many Western governments was that in crisis time, above all, they needed to balance public budgets, and if that meant cutting their (very limited) social expenditures at a time when they were most needed, then that should be done. In the US and elsewhere, with over a quarter of the male workforce unemployed, it was a worrying time. There was much interest in new and different approaches such as the state planning and control in the newly formed Soviet Union, and state corporatism that was being practiced by the national socialist governments in Italy and Germany.

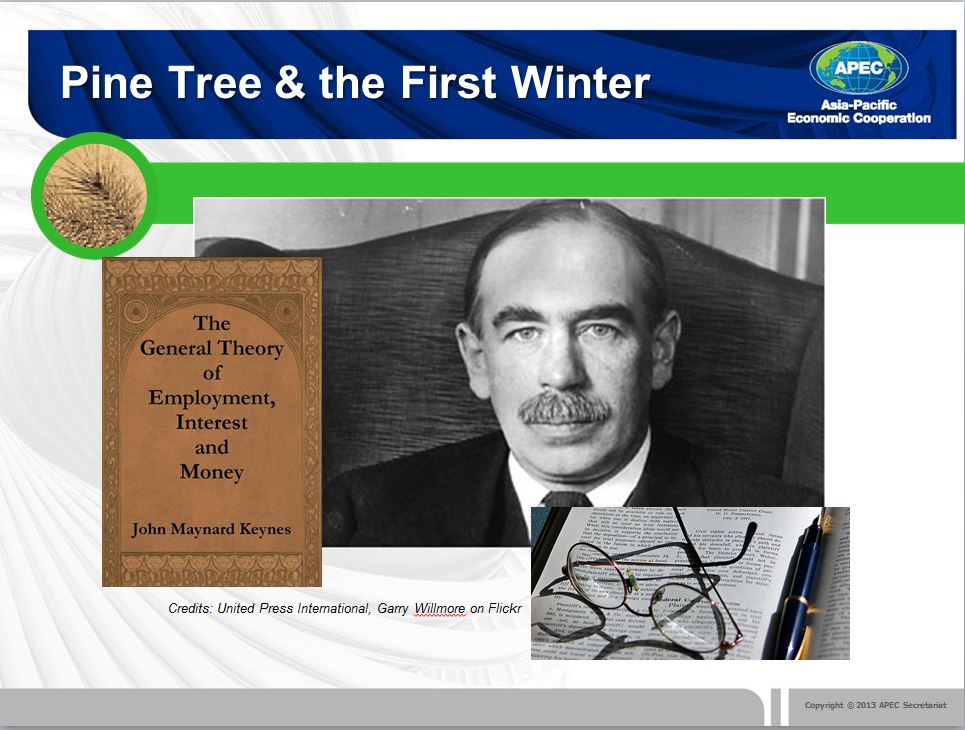

British, Scandinavian and American academic economists all focused on the challenge of ending world depression. This was the first time that economists had looked to apply their theory and thinking to practical policy problems of such a magnitude. In 1936 J. M. Keynes published his “General Theory of Employment, Interest and Money”. Whereas neoclassical economists had seen unemployment as being largely determined by the price of labour, Keynes argued it was determined by aggregate demand, i.e. people’s spending. A year previously he wrote to George Bernard Shaw: “I believe myself to be writing a book on economic theory which will largely revolutionise….the way the world thinks about its economic problems”.

Most reviews of the book were initially very critical. It took John Hicks in Britain and Paul Samuelson and Alvin Hansen in the US to re-work its economic context within a neoclassical synthesis before it really did revolutionise the world.

The argument was that governments should be prepared to stimulate economic demand when there was slack capacity. Keynes had been thinking about this for several years and had in 1933 written an open letter to Franklin Delano Roosevelt proposing such policies. Keynes’ concept of counter-cyclical spending policy provided the basis for modern thinking on fiscal policy – the use of taxes and expenditure to help stabilise an economy.

The US New Deal, a major pioneering program of public works and related government spending, is often seen as the best illustration of Keynesian economic policy. But although he was used to provide ex-post justification, in fact Keynes did not much influence it. His book was published after the program was well underway. Though he had held a meeting with FDR, he did not much influence US policy at this stage: in fact the US New Deal was opposed to the concept of deficit financing.

In fact it was the 1935 Labour Government in New Zealand that provides one of the best illustrations of Keynesian reflation, with its focus on spending on employment benefits and other social security measures.

The Depression experience in Singapore was different. Rocked by the decline in world trade, the falling price of tin, and the price of rubber (which plummeted from 34¢ to 5¢ a pound between 1929 and 1932) there was much hardship in the absence of much social spending. However the Japanese invasion of Manchuria and later of much of China brought rapid increases in rubber and tin prices and production by 1934; shortly afterwards the British started spending on massive public works for defence, especially the huge naval base, all of which kick-started the local economy.

Keynes had a degree in statistics not in economics, and his contributions were principally in logic and moral argument, illustrated by real world examples but not testing formal hypotheses. He had no computing aids, did not focus on data sets, and apparently felt no lack of them. He wrote his pages in long-hand, (sometimes while in bed). His friends and colleagues were philosophers, historians and artistic people.

The rearmament of Europe and Japan and eventually the carnage of World War II empowered ministries of production and ministries of finance. Their employees changed from being administrators into clerks and accountants keeping tallies, recording data, and using statistical techniques. Following pioneers like Jan Tinbergen, the new occupation of “planner” evolved, aiming to build production capacity. Economic information and control were to prove hugely important during the war, winning and losing battles. Examples are Russia’s use of cybernetics to plan their massive war effort, the application of Leontief’s input-output analysis to identify pressure point sectors for saturation bombing by the Allies, and the use of linear programming and other operations research techniques by the Americans to run their Pacific War. In the East, one might argue that the fall of Singapore was largely due to the cutting of essential infrastructure. Eventually the defeat of Japan occurred because its supply lines could not stretch far enough.

All in all, the war experience revolutionised economic policy. In the post-war years the problem was to meet the huge unsatisfied demand for reconstruction and consumer goods. Later the start of the Cold War fed defence spending, but also delivered a revolution in computing capacity. Large frame computing, optimization techniques and macroeconomic planning became common-place.

War-time had increased government spending significantly. Rather than revert to their much smaller pre-war roles, governments now wanted to convert their spending into social support: witness the Beveridge Report in the UK and the Kennedy-Johnson War on Poverty in the US. It was in the 1960s that governments started setting up specialist economic agencies, appointing specialists in government, and actively looking to academics for practical policy advice.

This was the environment that I grew up in: parents who recalled the Depression and the War and extorted us not to waste, politicians brought up on the state interventionist policies of New Zealand’s New Deal, and economics professors grown up with Keynesian economics and the main tool it offered : fiscal policy. The macroeconomics framework taught was based on Hicks. Our most memorable overseas visitors were J. K. Galbraith, a keen proselytiser of active Keynesianism, Paul Samuelson who did more than anyone to spread the Keynesian model through his widespread student textbook, and Lawrence Klein whose Wharton School models pioneered large scale computing models with practical testing and forecasting applications.

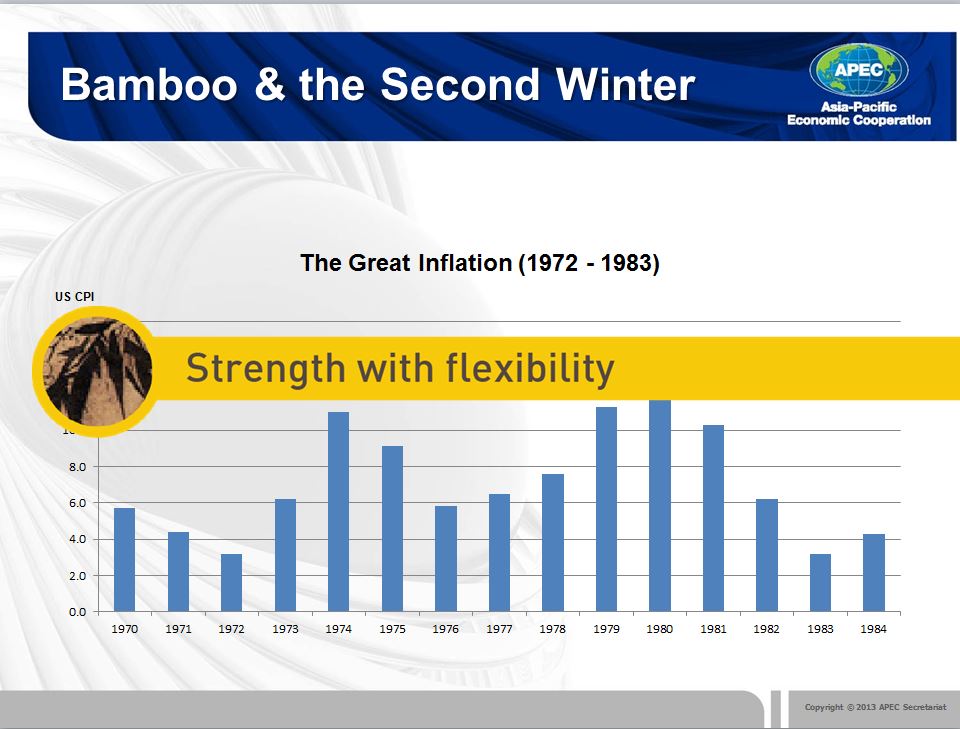

The Second Winter of the 1970s: The Great Inflation.

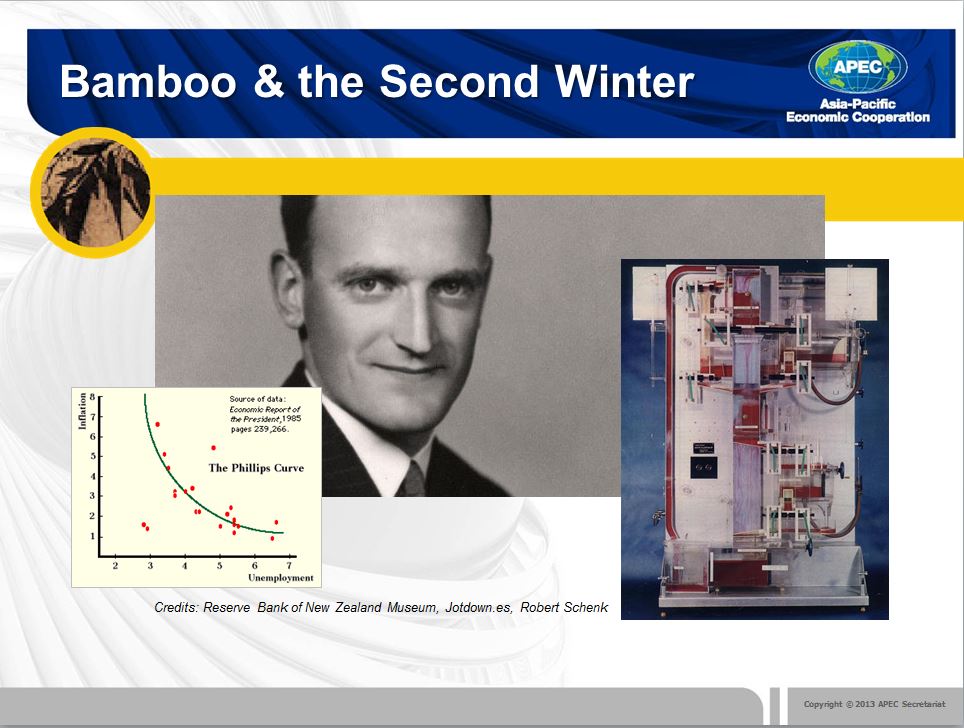

If the pine tree symbolises endurance, the bamboo symbolises strength with flexibility, and here we illustrate the story of flexible inflation targeting. The General Theory sparked the debate that led to the development of fiscal policy, our first ‘Friend of Winter”. The publication that ultimately was to lead to the second ‘Friend of Winter’ modern monetary policy was an article, unappealingly entitled “The Relation Between Employment and the Rate of Change of Money Wages in the United Kingdom, 1861-1957”,[3] better known as the Phillips Curve article by Bill Phillips, a New Zealander.

While Lord Keynes came from the British upper classes and effortlessly entranced the Establishment, Bill Phillips was his polar opposite : raised on a remote New Zealand farm, he was forced to leave school in that first economic winter, the Great Depression. He was apprenticed as an electrician, spent an adventurous and at times horrifying decade travelling through East Asia and Europe, re-armed planes in Singapore, and was incarcerated by the Japanese in a prisoner of war camp on Java. At the London School of Economics after the War, Bill Phillips discovered and estimated what appeared to be a robust relationship between unemployment and the rate of change of money wages. This sparked off an industry of economic research, and ultimately one of the most furious controversies about economic policy. His paper remains one of the most cited ever in economics.

Bill Phillips represented another generation, one with a completely different set of skills and experiences. Ironically, his initial qualifications were not in economics either. He was an electrician who had achieved a bare pass majoring in sociology at LSE in 1949. But he proved a great innovator, built the world’s first dedicated analogue economic computer, the MONIAC, and in 1957 arguably carried out the world’s first dynamic modelling on electronic computers. Bill Phillips had no famous friends. His colleagues were technocrats, pioneering control theory and econometrics for economic applications. The Phillips curve was calculated from time series data that had been established during wartime, and his computation method was still very basic - electric calculator, a slide rule, log tables and a flexible curve – an amateur approach that he probably later regretted when the curve achieved world-wide fame. Later economic research on the Phillips curve used main-frame computers, better data sets, better econometric techniques and more sophisticated macroeconomic models. By the 1970s many large scale macro models were being estimated for simulation and prediction, embodying some form of Phillips Curve.

In contrast to Maynard Keynes, Bill Phillips was a very modest man. He later said: “All I did was to set up a few hares for others to chase.” It was left to Richard Lipsey in Britain, and Paul Samuelson and Robert Solow in the US to take up the Phillips result and draw some policy implications. [4] Their own research pointed to an apparent trade-off between two variables: unemployment and price stability. While academic economists were cautious about this, very quickly policy economists became intrigued as to whether they could actually select a trade-off position on the Phillips Curve, depending on their relative targets for employment and inflation. Before long, politicians were claiming such a trade-off as justification for their own actions (as was cited by Ted Callaghan, Chancellor of Exchequer, in the 1967 UK Budget). Usually this was in support of their claims to spend more money in pursuit of economic growth. Through the 1960s, there was much argument about whether economists really had such a policy choice, and whether they could achieve a lasting impact from it.

But the world was changing in the 1960s, and Governments were spending money again. The reflation arising from the US Government’s ‘War on Poverty’ in the 1960s, the growing spending on the Vietnam War, and the OPEC price hikes in oil in the early 1970s changed the scene: inflation across the OECD grew to worrying levels. In 1974 US inflation hit double figures and stayed very high for the decade. Singapore with its exposure to the oil sector was hit worse: inflation rose over 30% in the mid 1970s.

A static interpretation of the Philips Curve might have suggested that unemployment should fall under such conditions. But actually unemployment was growing at the same time as inflation, a condition we now know as ‘stagflation’.

The Phillips Curve debate raged amongst academics, splitting economists and policy makers, at their extreme, into “employment activists”, on the one side and “inflation-nutters” on the other. The famous Presidential Address in 1968 by Milton Friedman to the American Association of Economics and a seminal paper in the same year by Ed Phelps were extremely critical of the trade-off interpretations of the Phillips Curve.[5] They denounced the curve as nothing but a short term device. This view was reinforced by Lucas and Sargent in their work on rational expectations.[6] In short, their interpretation was that workers and businesses, faced with a government policy that tried to target employment, would pre-empt this by pushing up wages and prices, with consequent on-going pressure on inflation. The Lucas critique spelt our an even broader policy dilemma for economists: any policy that can be predicted by private agents will be pre-empted by them.

The “New Right” economics that arose from the ashes of the long term Phillips Curve offered a quite different recipe for macroeconomies. Instead of pursuing traditional “Keynesian” views about fiscal activism aimed at short term stabilization, it promoted ‘set and forget’ rules for fiscal policy. This implied setting medium term targets for debt and spending, enshrining these in legislation, and relying on monetary policy and automatic fiscal stabilizers for economic stabilization. In their view to intervene more actively would only harm medium term policy credibility, and could result in accidental cycle stimulation. Instead Ministries of Finance should focus on structural reform to enhance micro- economic flexibility, deregulating markets so that labour and other factors of production would speedily move at market prices to the uses of highest value. This approach was known as the ‘Washington Consensus’, and it was given some practical credibility by the success of central banks led by Paul Volcker and others, in reducing the inflation of the 1970s, and setting the scene for a long period of economic stability.

This new approach gave primacy to monetary policy through flexible inflation targeting as the main tool for stabilization. A further development has been the use of working rules for policy; policy-makers may not be as clever as they think they are, and under appropriate circumstances would be better off following set pre-announced rules for policy settings than discretionary intervention. The most well-known is the Taylor Rule which says that Central Banks should set interest rates based on the divergence from equilibrium inflation and output. Central banks have other momentum and integral rules that they follow (interestingly first developed for economics by Bill Phillips in 1954). An equivalent working rule for fiscal policy specifies leaves stabilization completely to automatic stabilizer. (e.g. more benefits paid in downturns, more tax collected in up-turns).

I have been fortunate enough to have held some key positions in the New Zealand Government with exposure to a number of areas of economic policy. In 1997, at the peak of the East Asian Crisis, I was appointed to head the New Zealand Treasury, that key department that advises on fiscal policy and the broader economic role of government. The New Zealand Treasury had led a number of key administrative and policy reforms during the previous decade. My previous role had been to head the New Zealand Commerce Commission, the competition regulator, where I had been focused on the macroeconomics of markets. The New Zealand Treasury at the time was following the new Washington Consensus, with a focus on structured reform, and leaving fiscal policy to play the part of an automatic stabiliser. New Zealand had been a world leader with its Fiscal Responsibility Act with its medium term fiscal targets. This legislation proved to be very effective in maintaining disciplined budgeting through a variety of different governments, and a strong fiscal position would later prove critically important for the country.

However with the East Asian crisis ranging around us, I soon learned that one ignores macroeconomic stability and economic forecasting at one’s peril.

In 2002, at the start of that cycle known as the Great Moderation, I moved to run the Reserve Bank of New Zealand and hence had the opportunity to judge the other part of the Washington Consensus, namely the role of monetary policy. The New Zealand Reserve Bank had been the first in the world to enshrine in legislation the new monetarist views about the appropriate role of a central bank. The 1998 Reserve Bank Act required us to target medium-term price stability using interest rate policy. Monetary policy could be guided by working rules such as the Taylor Rule. Market communications must be credible and medium term in focus, with the objective functions clearly articulated.

Over the next decade the New Zealand model of flexible inflation targeting was followed by 23 other central banks. These central banks saw their role as more disciplined and less ”meddling” than activist traditional central bankers. They gradually gained confidence in their ability to control inflation with their interest rate tool.

Of course computing and econometric techniques have developed considerably since the early work of Bill Phillips. It is possible that the judgemental role of the economist in modelling could actually be diminishing. Like the driverless car, there have been developments in ‘policy automation’. We have for example seen the use of the VAR models that use big data sets to compute recurring relationships among variables rather than relying much on prior economic thinking. Forecasters can use models that automatically accept or reject variables, and now we even have models of models.

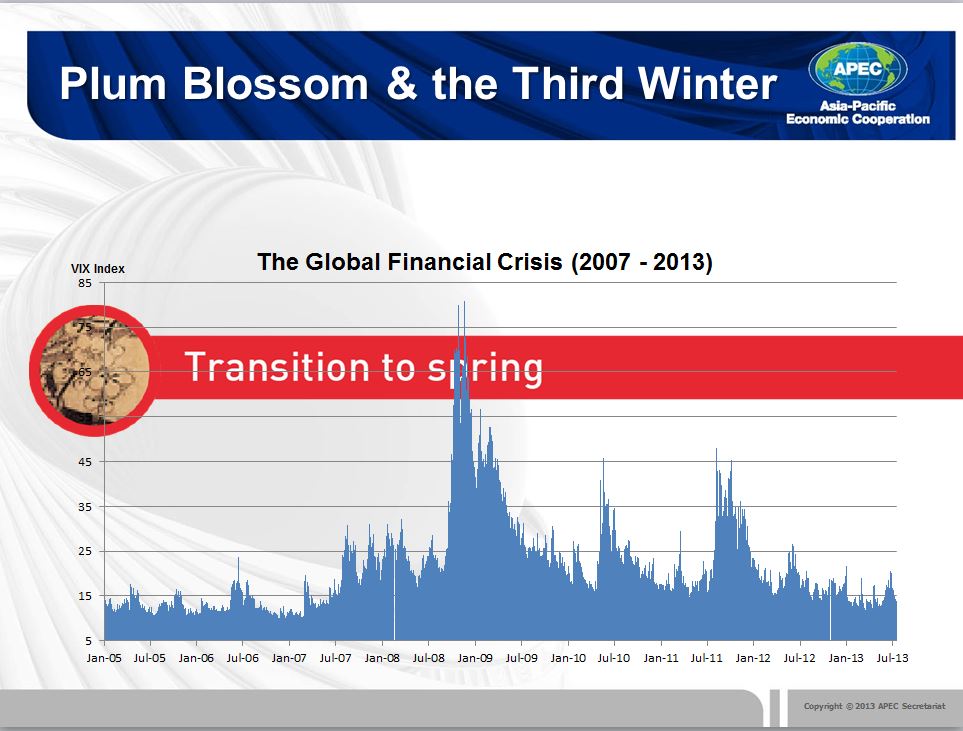

After five years of emerging market volatility in Treasury, my first period at the central bank saw much more settled world conditions. Our challenge was getting ahead of the curve as consumer prices inflated and banking credit rose. We used record high interest rates, seeking monetary policy that was tight enough without distorting the whole economy. But during my second five years in the position, starting in 2007, things changed rapidly as the Global Financial Crisis flared up around us. This marked a new winter ahead.

The Third Winter of the 2000s : The Global Financial Crisis

The plum blossoms symbolizes transition : it flowers briefly in winter, while spring still lies ahead.

We policy economists have just been through the biggest shock of our careers. This is true even for those of us who worked during tough times like the 1987 stock market crash, the LTCM drama, the East Asian crisis, other emerging markets financial crises, the tech-wreck, the productivity miracle, and the savings and loans debacle. Following the period called by some, “the Great Moderation”, we are now struggling with the Global Financial Crisis.

Following the first signs of sub-prime crisis in 2007, we witnessed the failure of some major US financial institutions including Lehmans the following year. The problems in banks led to rapid contagion through the major financial systems of the Northern Hemisphere, and by late 2009 resulted in a serious contraction in world trade followed by world recession. [7]Countries responded with radical, fiscal and monetary stimulus. After several years in recession, the economies in most of the OECD countries started to improve, only to see some of them, especially in Europe, drop back again into stagnation.

As she opened the new LSE building in 2007, The Queen of England asked: “Why did no one see this coming?” Of course many commentators and researchers had been warning of such an event for some years, as the financial sectors became more overloaded and asset prices exhibited bubble behaviour. The Global Financial Crisis itself had multiple simultaneous causes linked by contagious interlinkages via global financial institutions. Overall there was a serious under-estimation of tail-end risks.

There was already a body of microeconomic thinking about financial sector balance sheet risks, although it had thought less about the interface with macroeconomics. It is very difficult to analyse financial system risks, let alone to forecast them. The major problems involve documenting and modelling the financial sector with its one-sided risks, connecting it to the macro economy via contagious linkages, and handling the mathematics of discontinuous shocks. [8]

As economists focus on the complex interface between the financial sector and the macroeconomy, this casts a light on what we now call “financial stability”.

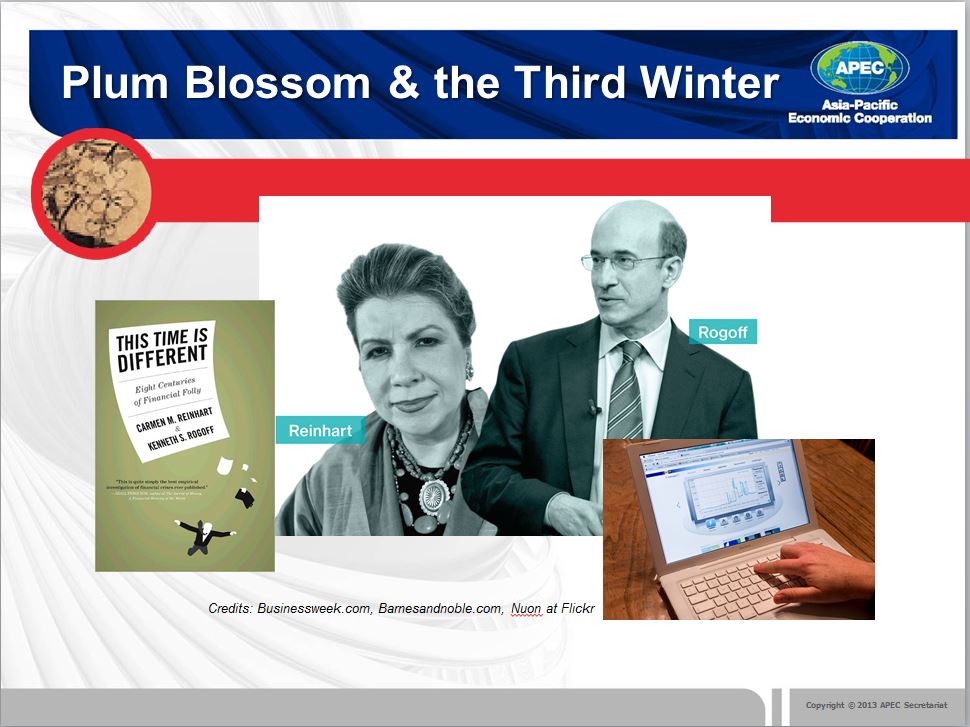

This crisis has spawned a huge output of economic work. Much of the research has been backward-looking, trying to address the question posed by the Queen. Arguably the leading authority has been a body of work by two US academics, Ken Rogoff and Carmen Reinhart, who have carried out a series of studies. They surveyed financial crises in 66 countries over eight hundred years, and the data from this long term focus shows some recurring patterns. They conclude that when a financial crisis coincides with an economic downturn, a very serious economic contraction can result. On average, imbalances build up for about seven years, and after the bubble bursts, it takes about another seven years before there is a return to trend. Disruptions of this scale prove very damaging. The Global Financial Crisis seems to be following this pattern.

This work was first seen by the academic community as a NBER working paper in 2008, while the Lehmans debacle was still underway. In enlarged form, the work was published the following year as a book, entitled (with a sense of irony) : “This Time Is Different”. The timing, the writing style, and the results captured the public interest in a way rarely seen with serious economic studies. It became a New York Times best-seller. Paul Krugman wrote (disapprovingly and with exaggeration): “Indeed Reinhart-Rogoff may have had more immediate influence on public debate than any previous paper in the history of economics”.[9]

Whereas Keynes had been quintessential British establishment, and Phillips a simple New Zealand electrician, these two hailed from quite different backgrounds. Carmen Reinhart had arrived in the US as a child refugee from Cuba, while Ken Rogoff had trained as a professional chess champion at age 16. Both went on to become products of top, highly competitive, publication-focused, US universities.

One line of enquiry has been to look at the build-up of imbalances in the lead-up to this and previous crises, to look for common threads, then to examine where the threshold level for deleveraging appears to be, and how this is transmitted between sectors and economies. There was considerable discussion of these issues before and during the crisis, at meetings of the Bank of International Settlements, at the Jackson Hole Federal Reserve Seminars, at many other central bank conferences, and at countless academic meetings.

These enquiries have not found it straight-forward to “predict” the Global Financial Crisis. However some research has identified threshold levels of government debt, threshold exposures of the financial sectors, and other imbalances beyond which macro-economic performance appears to suffer. Research by economists at the Bank of International Settlements has largely supported this work, concluding that as government debt surpasses about 80% of GDP it starts to become a drag on growth (it is now over 100% in most advanced economies). Of course it does not automatically follow that such exposures are the principal cause of instability, nor that instability can necessarily be avoided by reducing such exposures.

The work is particularly interested in thresholds beyond which instability might ensure. In brief, where are the danger zones for financial balance sheets and the no-go areas for fiscal expansion?

The policy implications of this work are now being hotly argued. On one side of the debate are those arguing that public debts and fiscal deficits must be reduced urgently, that quantitative easing is a potential danger threatening longer term inflation, and that banks must be forced to rebuild their balance sheets. This has been the broad approach recommended by the IMF and others, and it has been applied to problem EU economies. However the recent IMF report on the Greek crisis, which accepts some short-comings in the bail-out process, is a realistic indication of the complexity involved.[10]

On the other side of the argument, well-known economists like Paul Krugman and Joseph Stiglitz have publicly castigated austerity policies, recommending more fiscal expansion, more quantitative easing, and calling for much tougher bank regulation. This year a graduate student at the University of Massachusetts, seeking to replicate some results of a Reinhart and Rogoff study on fiscal imbalances, found some spreadsheet errors that weakened their conclusions on the casual relationship of debt and growth. This sparked renewed criticism of austerity programs by Krugman and others, and there is now a furious blog debate in progress about the relevant correlation and causality. In fact of course, European austerity programs have been based on a much wider range of economic work than just one economic study, as well as on market and political exigencies.

Keynes wrote some of his correspondence while in bed, and Phillips typed letters to colleagues in his office. For Reinhart and Rogoff the arguments are being pursued everywhere: blogs, emails, newspapers articles, conferences. For Keynes the argument was in words, for Phillips it was in algebra and basic econometrics on early mainframe computers. For Reinhart and Rogoff, the results come from software packages and laptops. They have access to huge data sets. Rather than toiling with annual statistics, they can now access data by the day, hour, minute or second if they want. Economics has changed from a high-brow philosophical science to a high-speed computing science.

In the meantime considerable economic research is being devoted to the policy challenges of recovery. If previous policy winters are any guide to experience, the outcome will probably be somewhere between the extremes of current interpretations.

The urgency of the Global Financial Crisis has brought radical fiscal policies, even in some economies that can barely afford them. Unorthodox approaches have also been applied to monetary policy. Most of the big economies have moved urgently to near-zero interest rates, and then tried to pump monetary stimulus through the system by using various untested forms of quantitative easing. Policy-makers have had to design, communicate, install, monitor and terminate quantitative easing in real time, with the consequent risk of misinterpretation, mistakes and financial market instability. It is estimated that the major central banks have pumped an extra $10 trillion of additional liquidity into their economies through various QE progress since the Global Financial Crisis.

As these policies have developed and become less orthodox, they have blurred the previous clear lines between fiscal policy, monetary policy and financial policy.

Ken Rogoff has recognised that the new policy approach needs to go further into the financial arena. He has recommended[11] recasting fiscal policy to incorporate credit market seizures, recasting monetary policy to incorporate financial market features, and casting a new light on financial market regulation.

The first “economic” friend of winter introduced modern fiscal policy, and the second introduced modern monetary policy. The third “economic” friend of winter has been the development of modern macro-financial policy. The major problems we face today are not just macro-economic stagnation but financial sector instability, now far more important because banks are more connected to the economy and the world than ever before.

Central banks and financial regulators have been adopting recent research to develop new financial stability tools. These involve recalibrating the regulatory requirements for banking capital, liquidity and other balance sheet measures. Roughly speaking, this reflects a move from the Basel I and Basel II regimes that proved insufficient to maintain the soundness of some individual banks during the GFC, towards the tougher standards of the proposed new Basel III regime. This represents a tighter micro-prudential focus on individual banks. The principles have been to internalise risks, align private incentives, and improve transparency.

But having observed how quickly a whole banking sector can seize up with financial infection, these policies have now gone further, incorporating macro-financial requirements. This involves intervention in the balance sheets of the financial sectors or in their lending policies (e.g. through imposing sectoral capital-weights, loan to value ratios, other housing sector restrictions, or special liquidity requirements). Unlike micro-prudential rules which are generally fixed in place and impact automatically, these macro rules are more likely to be discretionary, put in place when there is concern about asset price bubbles, strong credit growth or ultimately financial instability. One problem with these interventions is that if they are left in place for long, banks and customers will find ways around them. Hence they can be more effective if, like the plum blossom, they are only visible for a limited period.

At the Reserve Bank of New Zealand, we had responsibility for financial stability and bank regulation in New Zealand. We were one of the first central banks to produce and publish financial stability reports, commencing a decade ago. We redesigned bank regulation to a New Zealand version of Basel III. And we started work on the difficult area of macro-financial policy. This was aided by learnings from some of the housing and asset policies of countries like Singapore that had a history of intervention to promote or calm housing markets. We developed a New Zealand policy with four new macro-prudential instruments: a counter-cyclical buffer, a core funding ratio, sectoral capital requirements and restrictions on high loan to value ratio mortgages.[12] The Reserve Bank is currently considering their application.

Macro-financial policy is still work in progress: bank capital still seems gravely under-supplied in some northern economies which is stressing the operations of banks there, while volatile flows of capital have moved in and out of emerging markets causing distortions there.

As a result, there are big economic challenges ahead: particularly the recovery in Europe, the termination of quantitative easing, and the rationalization of fiscal policy in the US, fiscal recovery and growth in Japan, and the normalization of interest rates and inflation globally. All this must take place in an unsympathetic environment where markets are volatile, where globalization means spillover effects are stronger than ever before, where demographic trends are mitigating against growth, where many emerging economies are running up against a middle income trap, and where many developed economies are still struggling to rebalance.

Conclusions

I have now moved on to head the Secretariat of the Asia-Pacific Economic Cooperation organisation. For me that means immersing myself into another area of economics : trade and international economic policy. Here there is a long corpus of economic thinking since the days of David Ricardo, though the problems of unbalanced capital flows and exchange rates remain with us.

Looking back there are many learnings to be taken from the three friends of winter. We learn to be clear about the goals of economic policy, separating out stabilization from other objectives. We may argue about how much policy should be discretionary and how much automatic, how much should be market-driven and how much interventionist. We learn that policy breakthroughs do not occur in a straight forward way. In reality, in each of the three winters, policy demands drove theoretical developments and vice versa: there have been feedback loops, between economic conditions and policy developments. Controversies and confusions followed, and they seem inevitable.

The three economic friends of winter all ultimately work on aggregate demand. They do not operate independently. In this interconnected world, they need one another. Fiscal policy was an outcome of the Great Depression. A learning from the Great Inflation was that modern monetary policy needs “friends”, i.e. fiscal discipline. And as New York Federal Reserve Chief points out in his conclusions from the Global Financial Crisis, monetary policy requires financial stability policies to work as well.[13]

Like economic and financial crises, policy development and its application is becoming more global and in the daily headlines. In contrast to the privileged amateur of Keynes’ time, and the talented technician that was Phillips, the subject is much more popularised today. To reconstruct President Nixon’s comment about Keynesians, “We are all economists now.”

Traditionally Chinese ink painting was done by learned artists, using traditional equipment; willow charcoal, animal-hair brushes, earth pigments. Today most ink painting is done by enthusiastic amateurs, wielding cheap synthetic inks, inorganic pigments and polymer brushes. So too in economics: data is everywhere, computing is accessible, logs are democratic, everyone has their view.

We have looked at three wintery landscapes (the Great Depression, the Great Inflation, and the Global Financial Crisis). They have brought to the front three major economic advances, articulated in Keynes General Theory, Phillips’ Curve, and Reinhart-Rogoff’s This Time Is Different. These have been instrumental in developing three “friends” of economic winter (modern fiscal policy, monetary policy and macro-financial policy). These policies use three tools: the government budget, interest rates and credit controls, and they empower three institutions: ministries of finance, central banks and bank regulators.

It has been suggested that the three plants of winter, together embody the ideals of a Confucian scholar official (surely the forerunner of today’s policy-maker) who must be prepared to endure tenacity in spite of adversity. We must now see whether the endurance of the pine, the flexibility of the bamboo, and the flowering of the plum blossom can together stand against the still harsh wintery landscape of the Global Financial Crisis.

[1] I have deliberately simplified these pictures significantly.

[2] For an entertaining account see L. Ahamed, Lords of Finance: The Bankers who Broke the World, 2009.

[3] Economica, 25(100), 1958, pp283-99.

[4] R. Lipsey, “The Relationship Between Employment and the Role of Change of Money Wages in the UK”. A Further Analysis, Economica, 27,p1-31 (1960); P Samuelson and P P R Solow, ”Analytical Aspects of Anti-Inflation Policy”, American Economic Review, 50(5), p177-204 (1960)

[5] M. Friedman, “The Role of Monetary Policy” E. Phelps, “Phillips Curve, Expectations of Employment and Optimal Inflation over Time”, Economica, 34(8), p254-81 (1967).

[6] R. Lucas, “Econometric Policy Evaluation”, in The Phillips Curve and Labor Markets, K Brunner and A Meltzer (eds 1, p19-46 (1973) and T J Sargent and N Wallace, “The Stability of Models of Money and Growth with Perfect Foresight”, Econometrica, 41, 1043-8 (1973).

[7] Using the IMF definition of world GDP below 3%

[8] See C. Goodhart, Some New Direction for Financial Stability, Per Jacobsson Foundation Lecture, 2004.

[9] Paul Krugman, “How the Case for Austerity has Crumbled”, New York Review of Books, June 6, 2013

[10] International Monetary Fund, Leaked Document, June, 2013

[11] “The Challenges Facing Modern Macroeconomics” Mimeo (2010)

[12] For an up-to-date review see RBNZ, Macroprudential Policy, 2013

[13] Bill Dudley, Address to the Bank of International Settlements AGM, 2013