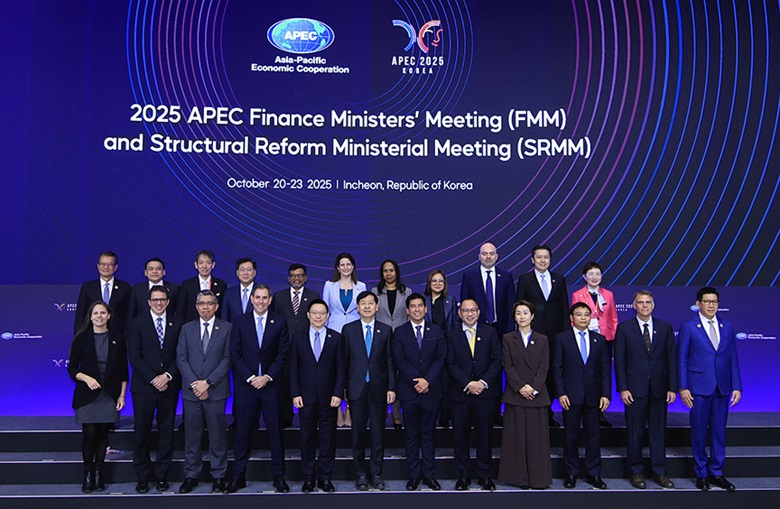

2025 APEC Finance Ministers' Meeting

2025 APEC Finance Ministers’ Joint Statement

Incheon, Republic of Korea, 21 October 2025

1. We, the APEC Finance Ministers, convened our 32nd annual meeting in Incheon, Republic of Korea on October 21, 2025, chaired by Koo, Yun Cheol, Deputy Prime Minister and Minister of Economy and Finance of the Republic of Korea.

2. Under the 2025 APEC Finance Ministers’ Process (FMP) theme of “Sustainable Growth and Shared Prosperity in the Region”, aligned with the Putrajaya Vision 2040 and the Aotearoa Plan of Action, we reaffirm our commitment to fostering an open, dynamic, resilient, and peaceful Asia-Pacific community by 2040, for the prosperity of all our people and future generations. We engaged in meaningful discussions on innovation, digital finance, and fiscal policies to promote the prosperity and resilience of the region. We also marked the conclusion of the Cebu Action Plan and welcome the launch of the Incheon Plan, a new roadmap that will guide the FMP over the next five years.

Global and Regional Economy

3. The global economy has shown resilience in recent years, although its outlook remains uncertain. Downside risks persist due to ongoing policy uncertainty, geoeconomic tensions, and global debt challenges. APEC economies stand together at a pivotal moment to advance collective efforts to enhance economic resilience. We support the various contributors to international cooperation, quality job creation, and economic growth.

4. In response to heightened economic uncertainty and moderating growth prospects, we emphasize the need to maintain flexible and credible macroeconomic policies. We underscore the importance of enhancing the effectiveness and quality of public spending, while continuing to implement appropriately calibrated fiscal policy to bolster economic resilience. We reiterate the relevance of effectively addressing debt vulnerabilities, including through the joint efforts by official and private borrowers and creditors to improve debt transparency. We also reaffirm our 2021 exchange rate commitments. We further highlight the importance of reinforcing supply chain resilience to enhance economic stability.

5. We emphasize the role of strong multilateral cooperation, including through international financial institutions, in the APEC region as a critical driver for economic growth. We recognize the importance of long-term policy adjustments to respond to structural transformations, including innovation and digitalization, frequent extreme weather events and natural disasters and demographic shifts, to lay the foundation for economic growth. In 2025, we discussed ways to leverage the strengths of each member economy to foster shared prosperity in the region.

Innovation

6. We underscore that innovation-driven productivity growth is a key driver of economic growth in the APEC region. In particular, we stress the importance of close collaboration among governments, the private sector, and other relevant stakeholders to foster growth and address common challenges that slow innovation. We emphasize the need to enhance and voluntarily share knowledge on mechanisms that mobilize both public and private investment to support micro, small, and medium-sized enterprises (MSMEs) and startups. We also underscore the importance of facilitating the accelerated flow of innovation within the Asia-Pacific region, enhancing knowledge sharing and fostering an open and diverse innovation ecosystem. In addition, we acknowledge the value of facilitating the scale-up of high-potential startups and driving innovation, technology adoption and job creation.

7. We recognize that artificial intelligence (AI), which is rapidly evolving, is a key technology for enhancing industrial competitiveness and strengthening economic growth across sectors. We emphasize that making effective use of AI as a valuable tool for innovation requires active coordination and adoption of both the public and private sectors. To enable innovation and adoption, it is important to ensure that regulatory regimes are conducive to AI development and deployment. We encourage economies to ensure that such regimes are fit-for-purpose and safeguard consumer protection. We underscore the importance of fostering an enabling environment for AI infrastructure, including energy, digital connectivity, and data systems, which is safe, secure, reliable and accessible for all. The sustained development of the AI ecosystem requires the cultivation and strengthening of skilled AI talent. In this context, we believe finance ministries can play an important role in supporting the AI ecosystem and creating the appropriate incentives for the market. This may include tax incentives, promoting AI-related industries, partnering with the private sector, or supporting investment in enabling infrastructure and AI talent development.

8. We welcome the first-ever joint session between Finance and Structural Reform Ministers. As appropriate, we emphasize the importance of continued collaboration with relevant APEC fora, particularly on structural reform, to advance our shared goals of enhancing productivity in the region.

Digital Finance

9. We recognize that digital financial innovation and resilience are key drivers of economic growth. We emphasize the importance of forward-looking policy strategies to harness the benefits and manage challenges associated with digitalization in the financial sector. The rapid development of digital technologies is reshaping the financial landscape, presenting both opportunities and challenges for financial development. The evolving digital environment introduces some risks, which at scale may undermine financial stability, integrity, and consumer trust. We acknowledge the need for a balanced approach that supports digital financial innovation and maximizes the benefits of digitalization, while addressing risks and protecting consumers through a right-sized regulatory footprint. We note efforts to expand quality access to credit, advance digital access for all, and reduce barriers that prevent businesses such as MSMEs from fully participating in the digital economy, which emphasized in Lima Roadmap to Promote the Transition to the Formal and Global Economies (2025–2040).

10. We acknowledge the expanding role of AI in transforming financial services and contributing to a more accessible, efficient, and personalized financial ecosystem. We recognize its potential to improve financial decision-making, expand access through alternative credit assessment, and strengthen risk management systems. We support ongoing efforts to promote responsible and human-centric use of AI in finance, enhancing accessibility for all.

11. We encourage member economies to strengthen cross-border collaboration and enhance knowledge sharing and capacity building in digital finance and emerging technologies on a voluntary and non-binding basis. We also recognize the need to address digital divides to ensure that the benefits of digital finance reach all within the APEC.

Fiscal and Finance Policy

12. We recognize the importance of fiscal policy in supporting long-term economic growth and resilience across APEC economies. APEC members have discussed measures to support fiscal effectiveness and medium-to long-term sustainability amidst fiscal challenges such as debt pressures, demographic shifts and natural disasters. Amid growing pressures on public finances, fiscal measures aimed at enhancing resilience to adverse shocks are fundamental. Responsible fiscal oversight— which includes prudent and strengthened debt management and credible, transparent budgeting and effective risk management, such as Disaster Risk Financing and Insurance (DRFI)—is imperative to safeguard macro-economic stability and to create sufficient fiscal space for strategic investment and other unforeseen needs. In the context of fiscal sustainability, we note the efforts of member economies in different sectors, including by implementing the Aotearoa Plan of Action, consistent with members’ own domestic contexts and current policy priorities.

13. Given limited financial resources, we acknowledge the important role of Public-Private Partnerships (PPPs) and quality expenditure as an effective mechanism for infrastructure development and public service delivery. PPPs can complement public investment by leveraging private capital and enhancing efficiency of project execution. Sound fundamentals—such as transparent design, adequate risk allocation, prudent fiscal risk oversight and proper contract management—are essential for PPPs to contribute to the public interest. We encourage economies to continue to share knowledge and best practices on a voluntary and non-binding basis.

Other Issues

14. We welcome the completion of the Cebu Action Plan, which has supported the work of the FMP over the past decade. Building on this foundation, we adopt the Incheon Plan to guide our collective efforts for the next phase of regional cooperation and to continue progressing towards the Putrajaya Vision 2040. It is structured around four pillars—Innovation, Finance, Fiscal Policy, and Access and Opportunity for All—each designed to address the key economic challenges and opportunities facing our economies. These pillars reflect our recognition that effective economic and financial policies must embrace technological progress, strengthen financial systems, maintain medium-to long-term fiscal sustainability and foster participation for all in economic growth.

15. We appreciate the continuous support for the FMP’s work from the Asian Development Bank (ADB), the Inter-American Development Bank (IDB), the International Monetary Fund (IMF), the Organisation for Economic Co-operation and Development (OECD), and the World Bank Group (WBG). We also acknowledge the contributions from the United Nations Development Programme (UNDP) and Development Bank of Latin America and the Caribbean (CAF). Furthermore, we welcome the active and ongoing collaboration of the private sector with the APEC Business Advisory Council (ABAC) and acknowledge ABAC’s recommendations to Finance Ministers. We note the work that some APEC economies and private sector have contributed to in the FMP Policy Initiatives such as Working Group on Regional Disaster Risk Financing and Insurance Solutions for APEC Economies (DRFI-WG), the Asia-Pacific Financial Forum (APFF), the Asia-Pacific Infrastructure Partnership (APIP), the Asia-Pacific Financial Inclusion Forum (APFIF), Asia Region Funds Passport (ARFP), the Asia Pacific Finance and Development Institute(AFDI) and the Sustainable Finance Initiative (SFI).

16. We express our appreciation to the Republic of Korea for hosting the 2025 APEC Finance Ministers’ Meeting, and we look forward to meeting again for our 33rd Finance Ministers’ Meeting in the People’s Republic of China in 2026.