Aid for Small Business in the APEC Region During COVID-19

In the last month, we have seen governments roll out unprecedented fiscal stimulus packages in aid of businesses as a response to equally unprecedented lockdowns on travel and economic activity meant to stem the spread of the COVID-19 pandemic.

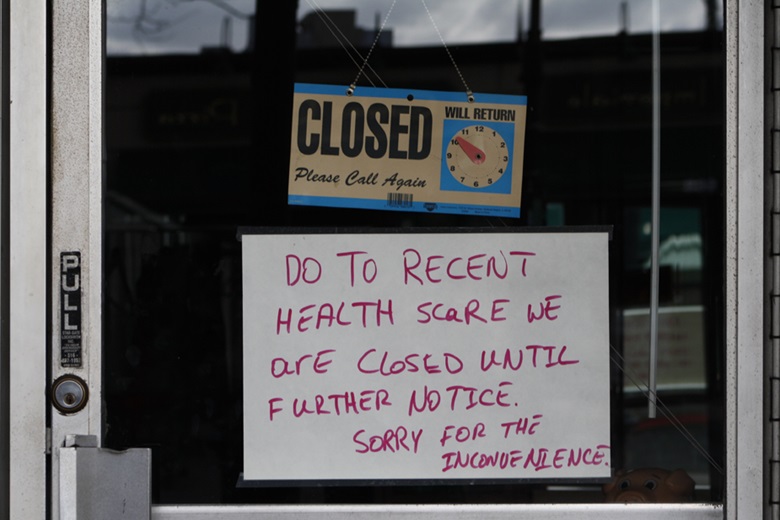

In this indefinite period, even the most efficient companies are facing challenges and are forced to lay off personnel, suspend operations or draw down cash reserves. Some even face permanent closure.

All but the most well-placed industries are at risk. The larger corporations have a better chance at emerging from this prolonged uncertainty. Small businesses may have problems keeping afloat. They need to continue to pay rental fees, utilities, wages and other costs amid the plunge in customer demand.

It is not surprising that economies are stepping up to mitigate the impact of COVID-19 by putting in place measures to help small and medium enterprises (SMEs) through this period.

There is a particular need for policymakers to tide them over. Small businesses are especially vulnerable due to their tighter cash flows and reduced access to financing. Facing months without revenue, many independent establishments like food hawkers, mom-and-pop retail shops and service providers will remain shuttered even after the lockdown, unless governments extend robust support.

All 21 members of APEC have responded to the ongoing COVID-19 pandemic by providing fiscal support to the health system, to households and to businesses. Within the APEC region, 16 economies have made announcements specifying the kind of support that will be extended to SMEs. These include:

- Lending/financing facilities catering exclusively for SMEs

- Low-interest loans as well as introducing loan guarantees and loan payment moratoriums

- Moratoriums on rental and utilities payments

- Temporary wage subsidies (usually covering up to 3 months of wages)

- Tax deferrals and tax refunds

It would be difficult to determine precisely how much of the stimulus is directed at small enterprises, as only 11 economies have specified the amounts set aside for SMEs. Taken together, these allocations add up to about USD 471 billion as of available data on 6 April. As the situation continues to evolve, economies could implement further rounds of stimulus measures especially targeting SMEs.

While public assistance for small businesses will be essential to their survival over the coming months, helping them thrive is good practice for policymakers regardless of the situation. SMEs contribute significantly to economic output—ranging from a 40 percent to 60 percent of GDP in many APEC economies. They also account for around a third of exports.

Furthermore, SMEs account for over 97 percent of all businesses and employ about two-thirds of the workforce across the APEC region. They employ vulnerable groups such as women, the youth, and elderly workers, which means giving small businesses a leg up contributes to economic inclusion.

Complementing economies’ efforts is the continued work of the APEC Small and Medium Enterprises Working Group (SMEWG). Even before the pandemic, the SMEWG has been promoting initiatives to help entrepreneurs and SMEs get easier access to financing, to international markets as well as to the digital economy. The onset of the COVID-19 pandemic highlights the importance of intensifying these efforts.

#

Dr Sta Maria is the Executive Director of the APEC Secretariat.